Who Is Jon Brooks?

Although Jon Brooks lives far from Oakland in the ultraposh Holmby Hills neighborhood of Los Angeles, he contributed $550,000 to the 2022 Oakland mayoral campaign of Ignacio de la Fuente, who finished a distant third. Brooks is currently suing the City of Oakland for more than $1 billion, alleging the City’s actions cost him the opportunity to earn a fortune from hosting Oakland’s long-threatened coal export terminal.

Yet few in Oakland have ever heard of Brooks, and fewer still have ever met him. Who is this high-rolling Angeleno who aims to have an outsized impact on Oakland?

Jon Brooks is the founder and sole owner of the Los Angeles-based hedge fund JMB Capital. Founded in 2002, JMB Capital now has more than $2 billion in assets under management. Brooks operates through JMB and a variety of affiliates, spinoffs, and shell corporations sharing a suite in the Los Angeles office tower at 1999 Avenue of the Stars.

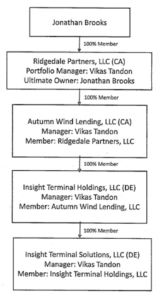

Most importantly to Oaklanders, Brooks now owns Insight Terminal Solutions, a company whose only significant asset is the legally contested right to build and operate a bulk commodity shipping terminal on the West Oakland waterfront. Jon Brooks disclosed his sole ownership of ITS in a document filed with the City of Oakland, which owns the 19-acre West Gateway property covered by ITS’s sublease.

Ownership chart provided to the City of Oakland by California Capital Investment Group in their Second Notice of Sublease, November 29, 2023

The proposed West Gateway terminal has been the subject of a nearly decade-long community struggle to keep Oakland from becoming home to the largest coal export facility on the U.S. West Coast. This struggle has given birth to No Coal in Oakland, Youth vs Apocalypse, the Interfaith Council of Alameda County, and a broad-based coalition that includes many Bay Area climate justice, labor, faith, and community activists.

Brooks’s involvement in the coal terminal project began in 2018 with a bad loan to John Siegel, a coal industry entrepreneur who had spent years negotiating with local Oakland developer Phil Tagami on plans for a coal export terminal.

Siegel’s companies had paid Tagami $13 million, to secure a series of exclusive negotiating agreements for a sublease that would give Siegel the right to build and operate a rail-to-ship terminal on the Oakland waterfront through the year 2082

One after another, the negotiating agreements expired without Siegel having taken down a sublease. In 2016, the City had passed a ban on coal and Siegel wanted the sublease in order to ship coal. Then, in 2018, a federal judge struck down Oakland’s ban on coal. Tagami again offered Siegel a sublease provided Siegel made a “take-down payment” (a signing fee) of $6 million.

Siegel had a brand-new startup company, Insight Terminal Solutions, lined up to sign the sublease. To finance the $6 million signing fee, he found a willing lender in Vikas Tandon, manager of a newly created Brooks entity known as Autumn Wind Lending.

Things soon took a turn south. Tagami learned that the City was about to declare his master lease on the West Gateway void for failure to meet construction deadlines set forth in the lease. Before news of the City’s actions became public, Tagami pressed Siegel to sign the sublease and pay Tagami’s signing fee. When Autumn Wind wrote the check to ITS, Jon Brooks and Vikas Tandon presumably had no idea that the City was in the process of nullifying Tagami’s master lease, an action that would render ITS’s sublease worthless.

Vikas Tandon may have felt a deep sense of betrayal, but neither he nor Siegel were ready to call it quits. Autumn Wind had just forked out $7 million and, with the aid of that loan, Siegel’s various companies had by now paid Tagami nearly $20 million for the exclusive negotiating agreements and the sublease itself. Although the City administration proceeded to cancel Tagami’s master lease, the collaborators were optimistic that the City Council would reverse this action.

But the allies soon had a falling out. The project was sinking fast. Siegel had not secured the financing he needed to move forward and he soon failed to meet the strict terms of Autumn Wind’s loan. Autumn Wind threatened to foreclose. ITS retaliated by filing for protection in bankruptcy – in Kentucky, where ITS was based.

A protracted battle for control of the company ensued, pitting Autumn Wind, as ITS’s largest creditor, against Siegel. Siegel tried in vain to find a way to salvage his investment. In 2020, Autumn Wind persuaded the bankruptcy court to adopt a reorganization plan to making Autumn Wind the owner of ITS with Vikas Tandon as its new CEO and Jon Brooks as its sole owner.

ITS’s only significant asset was, and remains to this day, the sublease it acquired in 2018 from Phil Tagami’s Oakland Bulk and Oversized Terminal LLC.

The value of ITS’s sublease remains in limbo. Whether the sublease is worth anything at all may depend on a ruling by the California Court of Appeal that may come down later this year. Brooks’s billion-dollar lawsuit against the City of Oakland awaits ruling by a federal judge in Kentucky on whether to pull it out of the bankruptcy court and transfer it to the Northern District of California.

Meanwhile, Jon Brooks has remained out of sight although he continues to invest behind the scenes in Oakland politics. If he has any plans other than to bring coal to Oakland or drain the City’s treasury, he has yet to make them public.